Table Of Content

How to Buy Amazon Stock

Buying Amazon stock is simple for most U.S. investors and can be done through a variety of online brokerages.

Here's a step-by-step guide to help you get started, with examples and use cases along the way.

-

1. Choose a Brokerage Platform

To begin, choose a brokerage platform that provides access to NASDAQ-listed stocks, such as Amazon (ticker: AMZN).

Most modern brokers, such as Fidelity, Charles Schwab, Robinhood, and E*TRADE, offer Amazon shares with commission-free trading.

Broker | Annual Fees | Best For |

|---|---|---|

Robinhood | $0 – $6.99

$0 for basic account, $6.99 for Robinhood Gold | Beginner Stock & Crypto Traders |

SoFi Invest | $0 | Automated Investing & Beginners |

eToro | $0 | Copy & Social Trading |

Wealthfront | 0.25% | Hands-Off Investors |

Webull | $0 | Active Day Traders |

Cash App Invest | $0 | Easy Stocks & Bitcoin Purchases |

Ally Invest | $0 | Mobile-Friendly Investing |

For example, if you're already using a mobile platform like Robinhood, you can search “Amazon” or “AMZN” and see key data such as analyst ratings, earnings history, and price targets.

Some platforms, like Schwab, also let you access third-party research tools like Morningstar reports, which can be useful if you want more in-depth analysis.

-

2. Create and Fund Your Brokerage Account

Once you've chosen a broker, you’ll need to open and verify an account.

This usually involves providing personal identification, employment status, and financial details. Then link your bank account to transfer funds.

Let’s say Amazon stock is trading around $175 per share. If you want to buy 5 shares, make sure you’ve deposited at least $875.

Alternatively, many brokers now offer fractional shares, allowing you to invest as little as $5 in Amazon—even if you can't afford a full shar

-

3. Learn About Amazon as a Company

Before investing, it’s important to understand Amazon’s business model and financial health.

Amazon is more than just an online retailer—it has massive operations in cloud computing (AWS), digital advertising, streaming, and logistics.

A good way to research Amazon is to explore its quarterly earnings reports, which break down performance by segment. For example, in Q4 2024, AWS generated over $24 billion in revenue, highlighting its role as a profit driver .

Use platforms like investing.com or TipRanks to evaluate its price-to-earnings ratio, debt levels, and analyst forecasts.

-

4. Place Your Order for Amazon Stock

After funding your account and doing some research, you're ready to place your first order. Simply search for AMZN in your brokerage app or desktop portal.

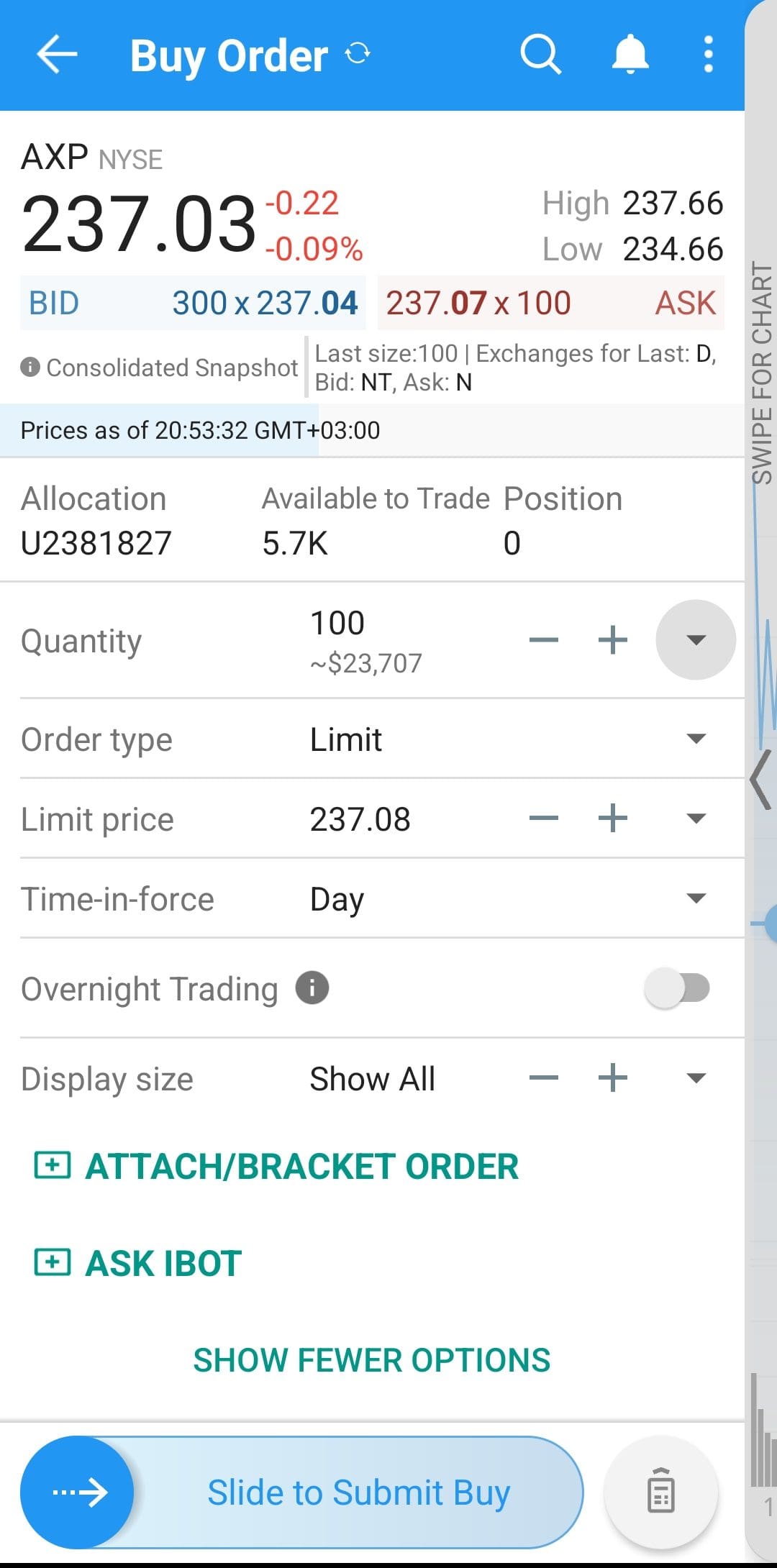

You’ll usually be asked to choose an order type:

Market order: Executes immediately at the current market price.

Limit order: Executes only if Amazon hits a specific price you set.

Fractional order: Allows you to buy a portion of a share (e.g., $50 worth of AMZN).

For example, if you want to buy only when Amazon drops to $165, you’d set a limit order at that price and wait for it to trigger.

-

5. Monitor and Manage Your Investment

After purchasing Amazon stock, keep track of your investment over time.

This means following earnings calls, market trends, and any news related to Amazon’s retail operations, cloud services, or leadership changes.

Let’s say Amazon announces a new AI-powered logistics platform—such a move could impact investor sentiment and the stock’s price.

Many brokerage apps let you set alerts, view analyst recommendations, and compare Amazon to similar stocks like Microsoft or Alphabet.

Because Amazon tends to be a long-term growth stock, many investors hold it for years as part of a broader tech or S&P 500 strategy.

How to Buy Amazon Stock Indirectly

If you're not ready to buy Amazon stock directly—or want broader exposure to the tech sector while still benefiting from Amazon’s performance—there are several smart, indirect ways to invest.

Each method fits different risk levels, investment goals, and account types.

-

Invest in ETFs That Hold Amazon Stock

One of the easiest ways to gain exposure to Amazon without buying individual shares is through exchange-traded funds (ETFs).

Many widely-held ETFs include Amazon as a major component due to its large market capitalization and influence in the tech sector.

For example, the Invesco QQQ Trust (QQQ) and the Vanguard Growth ETF (VUG) both allocate significant weight to Amazon stock because it is a core member of the NASDAQ-100 and a major player in the S&P 500 Growth Index.

By owning these ETFs, you're indirectly invested in Amazon, along with other high-growth tech giants like Microsoft and Google.

-

Mirror Amazon’s Ecosystem with Related Tech Stocks

If you’re more comfortable picking individual stocks but don’t want to buy Amazon itself, another strategy is to invest in companies that are closely tied to Amazon’s ecosystem.

Consider businesses that benefit from Amazon’s growth, logistics, or cloud services:

Shopify (SHOP) – Competes in e-commerce and often benefits when demand for digital retail grows across platforms.

Adobe (ADBE) – Provides marketing tools and cloud software often used by Amazon sellers.

NVIDIA (NVDA) – Supplies AI chips that power Amazon Web Services (AWS) and its AI infrastructure.

For example, if you believe in the expansion of AWS but prefer a pure play in semiconductors, buying NVIDIA might give you exposure to the same trends fueling Amazon’s cloud division.

-

Use Mutual Funds with Amazon Exposure

Mutual funds can also provide indirect exposure to Amazon. Actively managed funds often include Amazon in their top holdings, especially those focused on large-cap growth or innovation.

A good example is the Fidelity Contrafund (FCNTX), which frequently features Amazon among its largest positions.

Investors who prefer traditional mutual funds or already have retirement accounts like IRAs or 401(k)s can gain Amazon exposure this way without buying individual shares (source).

This route can make sense if you're investing through a workplace retirement plan that doesn’t allow individual stock purchases.

Buying Amazon Stock: Pros & Cons

Amazon is a dominant force in e-commerce and cloud computing, but like any stock, it comes with both advantages and potential drawbacks.

Pros | Cons |

|---|---|

Strong presence in retail and cloud | Doesn’t pay dividends |

Revenue driven by diverse segments | Priced at a high valuation |

Aggressive investment in innovation | Faces regulatory scrutiny globally |

Easy to trade with high liquidity | Retail margins remain thin and volatile |

- Strong Market Position

Amazon leads in both online retail and cloud services, giving it multiple revenue streams and a competitive edge.

- Consistent Revenue Growth

The company has shown long-term growth, especially through AWS and its expanding logistics and advertising businesses.

- Innovation-Driven Culture

Amazon continually invests in emerging areas like AI, healthcare, and robotics, which could fuel future profitability.

- High Liquidity and Accessibility

As a mega-cap stock traded on the NASDAQ, AMZN is easy to buy and sell, with tight bid-ask spreads.

- Low Dividend Appeal

Amazon doesn’t pay a dividend, which may not suit income-focused investors seeking regular payouts.

- High Valuation Risk

The stock often trades at high price-to-earnings ratios, making it vulnerable to corrections during market downturns.

- Regulatory Scrutiny

Amazon faces ongoing antitrust investigations in the U.S. and Europe, which could lead to fines or operational changes.

- Operational Costs & Thin Retail Margins

While AWS is profitable, Amazon’s retail arm runs on thin margins and high costs, which can weigh on earnings.

FAQ

No, Amazon does not currently pay a dividend. It reinvests profits into innovation, logistics, and new business lines to drive long-term growth.

Yes, many brokerages allow recurring purchases of Amazon stock or fractional shares. This strategy, often called dollar-cost averaging, helps you invest consistently over time.

You can open a custodial brokerage account (UGMA/UTMA) on behalf of a minor and purchase Amazon stock in their name. The assets transfer to the child when they reach the age of majority.

Yes, Amazon stock is available to international investors through brokers that provide access to U.S. markets. However, fees, currency exchange, and tax rules may vary depending on the country.

You can invest in Amazon with as little as $1 if your brokerage offers fractional shares. This lowers the barrier to entry even if you can't afford a full share.

Amazon is listed on the NASDAQ under the ticker symbol AMZN. It's part of major indices like the S&P 500 and NASDAQ-100.

Buying before earnings can offer upside if results beat expectations, but it also carries risk of volatility. Many investors wait for post-earnings stability before buying.

Yes, most major brokerages offer mobile apps like Fidelity, Robinhood, or E*TRADE, where you can search for AMZN and place your trade directly.

You can use platforms like Yahoo Finance, Google Finance, or your brokerage app to monitor price changes, earnings reports, and analyst ratings.

Yes, Amazon is a major holding in funds that track the S&P 500 or NASDAQ-100. These include ETFs like SPY and QQQ.